Pre tax contribution calculator

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Fill in your details to get started.

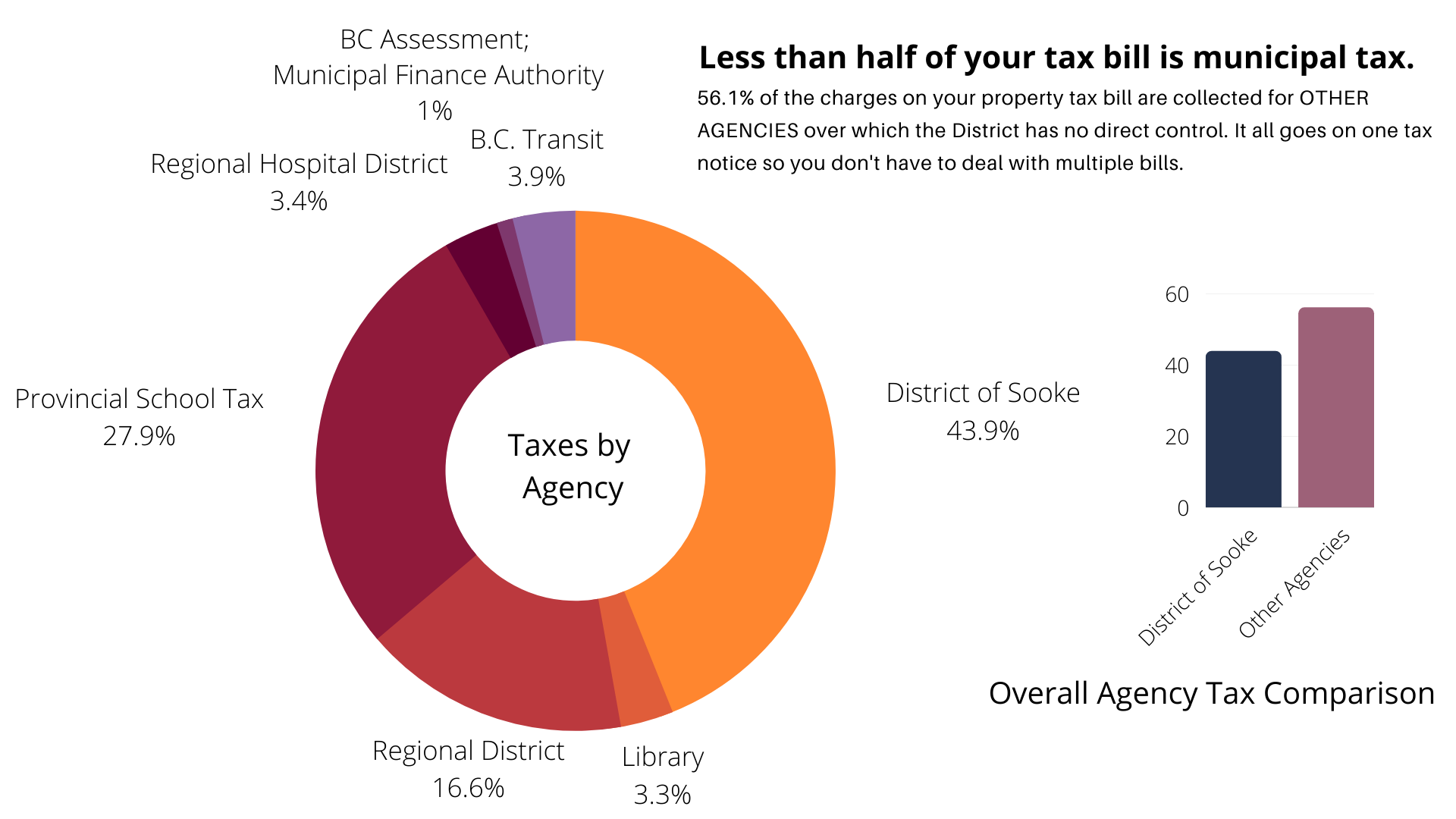

Property Tax Calculator

Your income is based on your superannuable before tax and superannuation contributions are taken out.

. If you are a Queensland Government employee. However this calculator does not take into account the maximum contributions base. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Net Income - Please enter the amount of Take Home Pay you require. The TFSA contribution restrict for 2022 is 6000 if you turned 18 prior to the calendar year 2009 your optimum life span TFSA contribution limit will be 81500. Pre-Tax Super Contribution Caps.

Limit helps reduce your tax liability are. The calculator should not be used if your Before-tax salary before any salary sacrifice. Check your tax code - you may be owed 1000s.

Weve explained how this works in detail in our tax relief on pension contributions guide. TDS advance tax and self-assessment tax payments. Contribution to 401 k S x C S x C x E.

Types of before-tax contributions include. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Determine your Tax Obligation.

Visit the Social Security please visit the Social Security Calculator smaller taxable income by the Internal Service. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. 8 of the annual salary.

The super contributions you make before tax concessional are taxed at 15. Use the income tax bracket rate during FY 2022-23 to determine the annual tax bill. If you choose dollars out of.

A 457 plan contribution can be an effective retirement tool. The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis - and pay no taxes on qualifying. The amount you will contribute to your retirement account each year.

This cap limits the amount that can. If his effective tax rate is 24 his tax liability for the year will be 024 x 75000 18000. The maximum pre-tax contribution amount that you can make into super is based on the concessional contribution cap.

This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month. The super co-contribution calculator is a tool to help individuals including the self-employed estimate their co-contribution entitlement and. The calculator will use this to determine eligibility for the Government low income superannuation tax offset if any.

When you make a pre-tax contribution to your. For comparison purposes Roth IRA and regular taxable. The calculator only allows for.

Employer contributions such as compulsory employer contributions and. Reduce tax if you wearwore a uniform. Enter key in the amount of contributions you are thinking about making to.

State income tax Federal income tax 3. Please note this calculator does. Her gross pay for the.

This is the NET amount after Tax the. To use this calculator simply add your annual income and how much you are paying into your. Free tax code calculator.

Transfer unused allowance to your spouse. For example consider an employee that earns 75000 gross income in a given tax year. 30000 10 30000.

Look at the impact pre-tax or post-tax contributions can make to your super and how they may change your take home pay. Calculate the employees gross wages Divide Saras annual salary by the number of times shes paid during the year. We also have an option to include the Married Couples Allowance if you are married and one of you have been born before the 6th of April 1935 you can tick the I am married and one of us.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

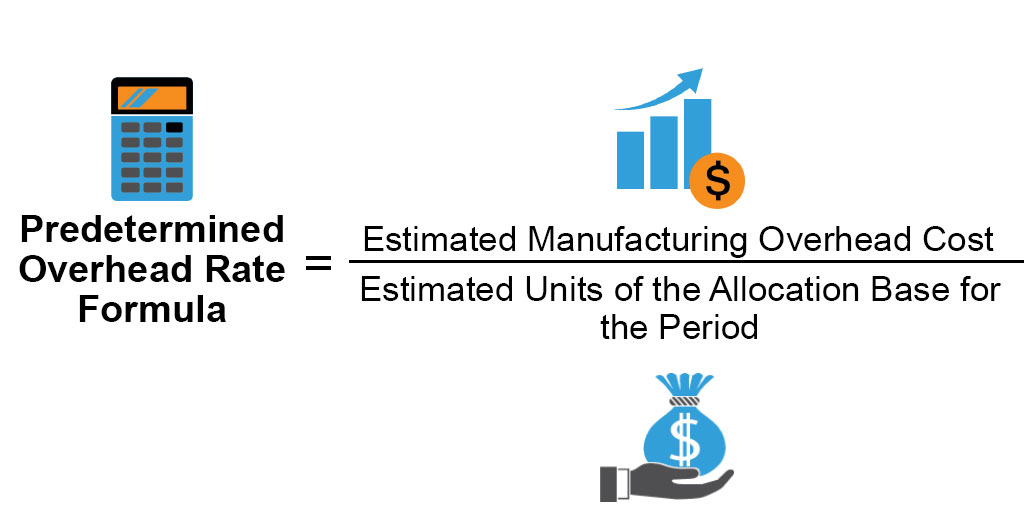

Predetermined Overhead Rate Formula Calculator With Excel Template

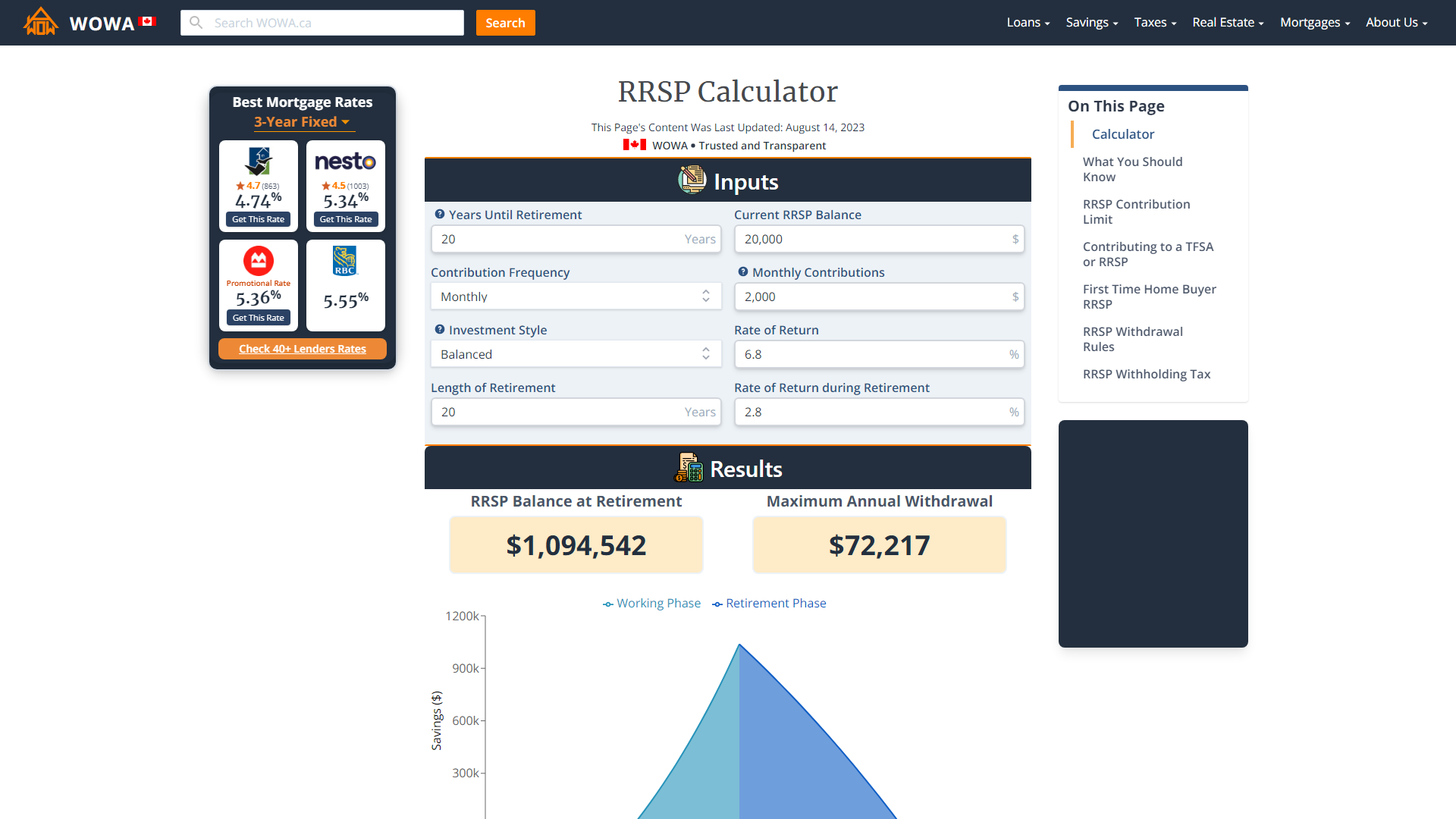

Rrsp Savings Calculator Wowa Ca

Traditional Vs Roth Ira Calculator

Paycheck Calculator Take Home Pay Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Net Profit Margin Calculator Bdc Ca

Ontario Income Tax Calculator Wowa Ca

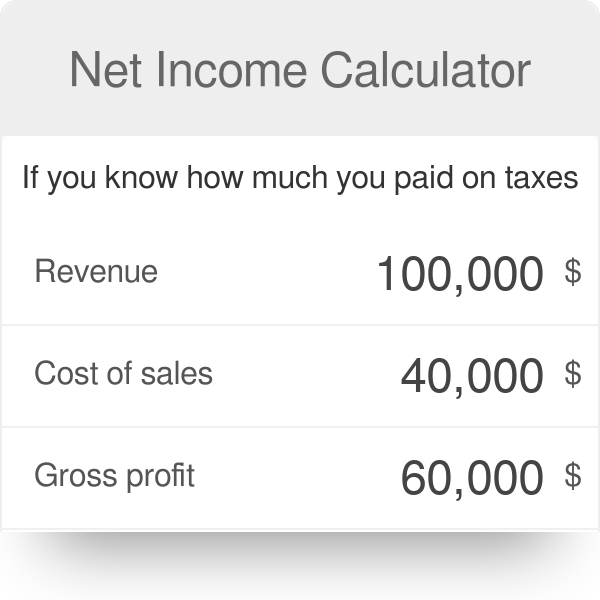

Net Income Calculator Find Out Your Company S Net Income

Our Retirement Calculator And Planner Estimates Monthly Retirement Income And Efficient Retirement Savings S Retirement Calculator Retirement Planner Financial

Paycheck Calculator Take Home Pay Calculator

Avanti Income Tax Calculator

Pre Tax Income Ebt Formula And Calculator Excel Template

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

Net Profit Margin Calculator Bdc Ca

50 30 20 Budget Calculator